diff options

Diffstat (limited to 'content/blog/2020-09-22-internal-audit.md')

| -rw-r--r-- | content/blog/2020-09-22-internal-audit.md | 264 |

1 files changed, 264 insertions, 0 deletions

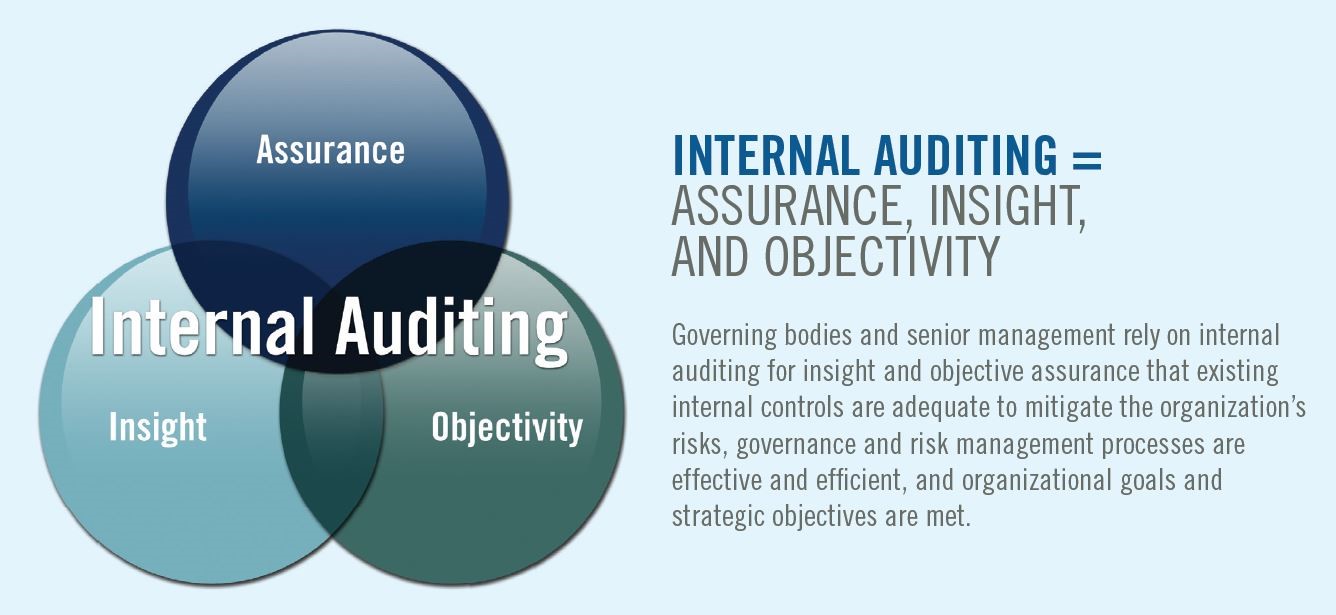

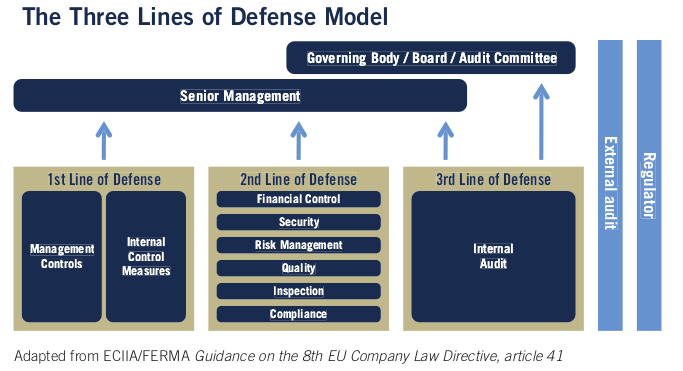

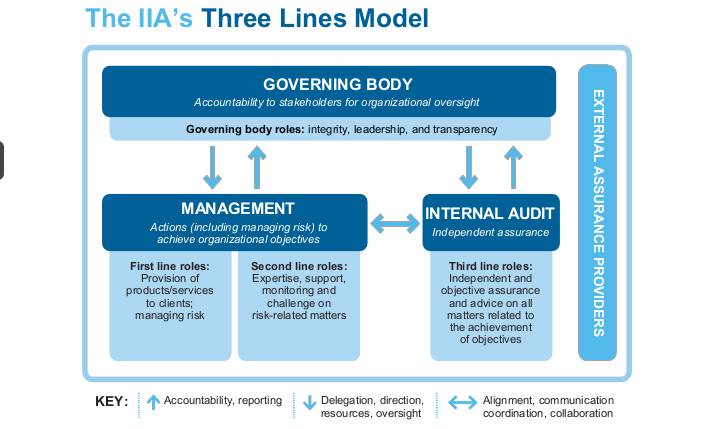

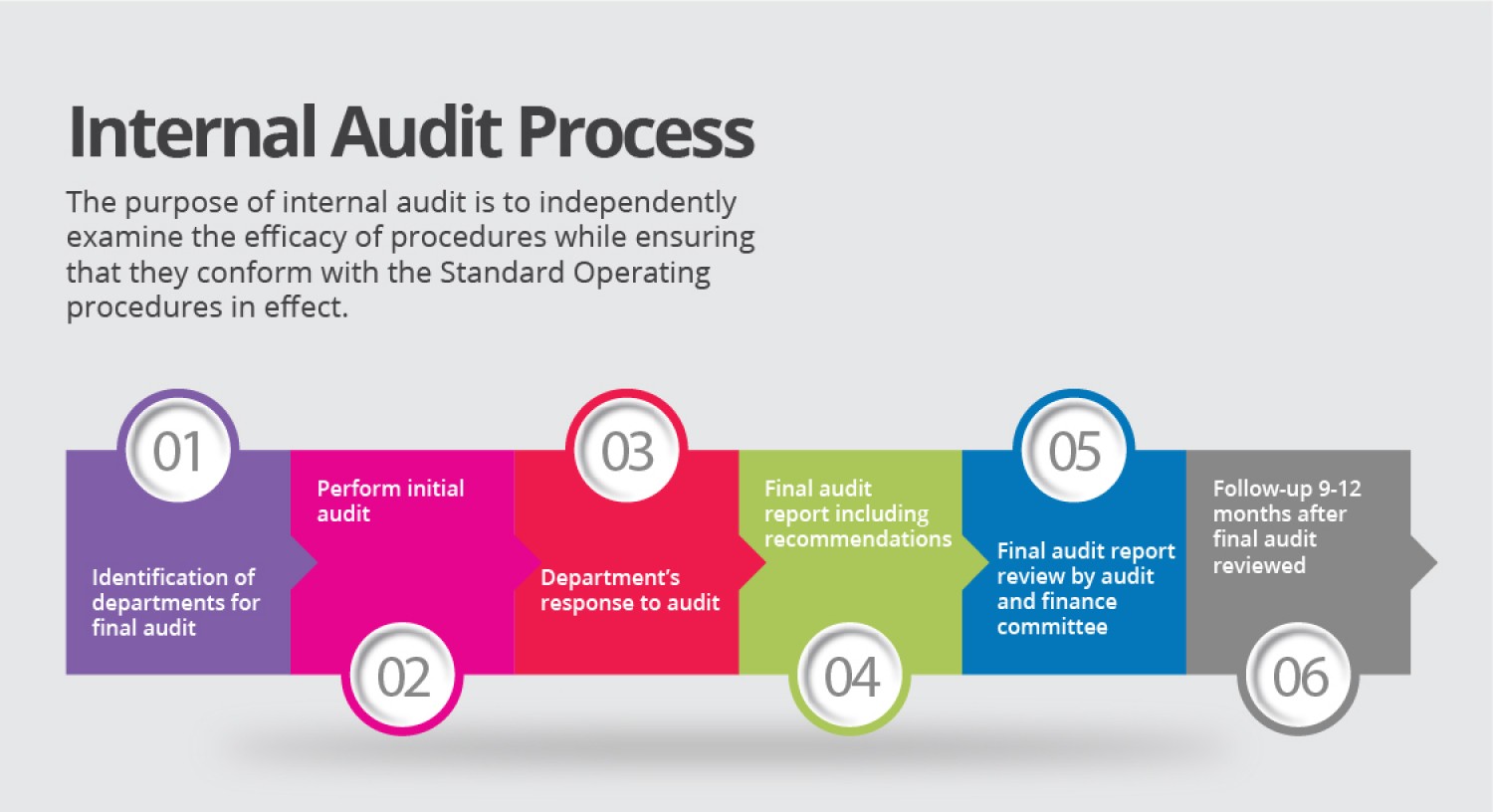

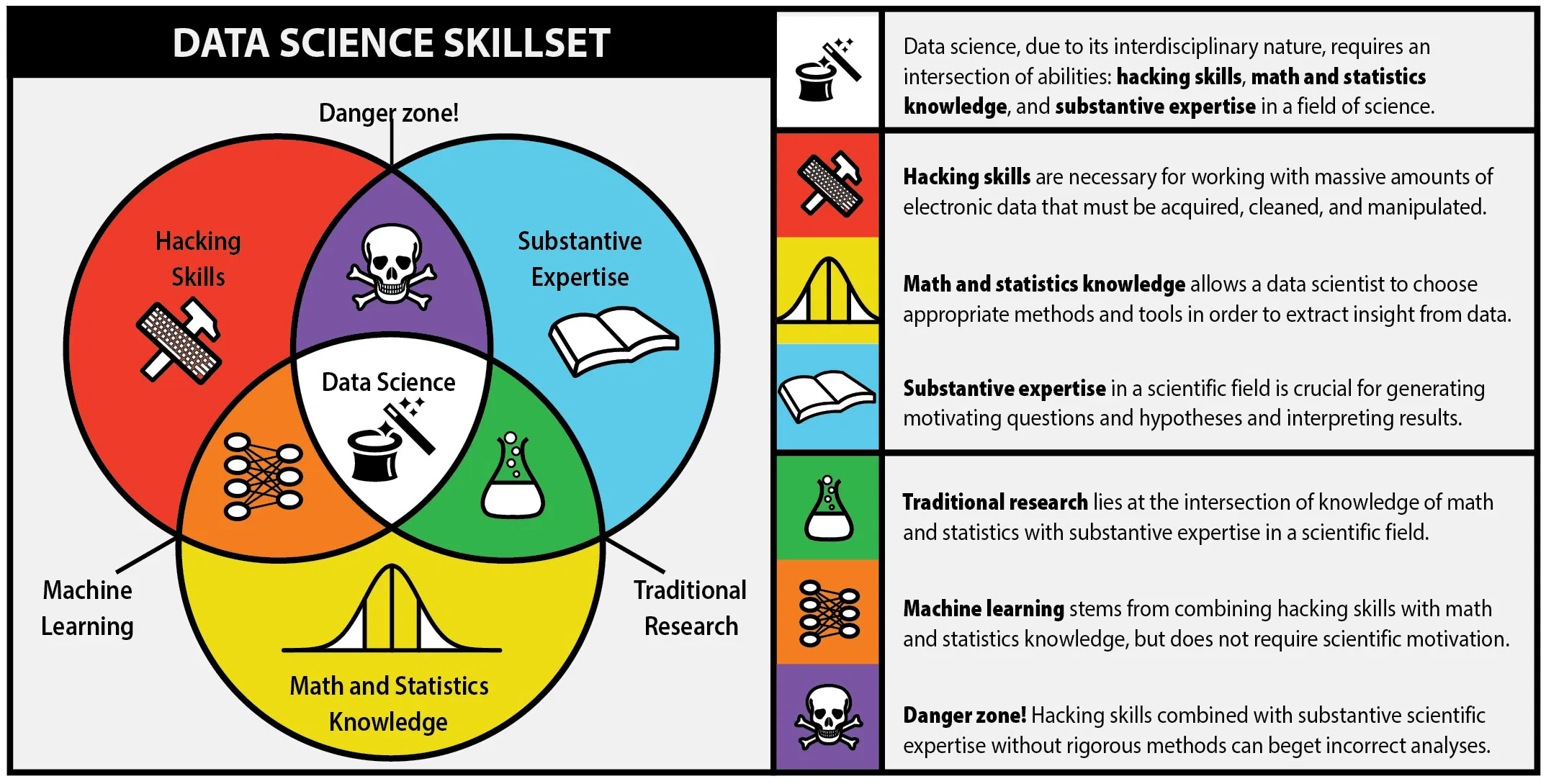

diff --git a/content/blog/2020-09-22-internal-audit.md b/content/blog/2020-09-22-internal-audit.md new file mode 100644 index 0000000..b700062 --- /dev/null +++ b/content/blog/2020-09-22-internal-audit.md @@ -0,0 +1,264 @@ ++++ +date = 2020-09-22 +title = "Who is Internal Audit?" +description = "" +draft = false ++++ + + + +# Definitions + +One of the many reasons that Internal Audit needs such thorough +explaining to non-auditors is that Internal Audit can serve many +purposes, depending on the organization\'s size and needs. However, the +Institute of Internal Auditors (IIA) defines Internal Auditing as: + +> Internal auditing is an independent, objective assurance and +> consulting activity designed to add value and improve an +> organization\'s operations. It helps an organization accomplish its +> objectives by bringing a systematic, disciplined approach to evaluate +> and improve the effectiveness of risk management, control, and +> governance processes. + +However, this definition uses quite a few terms that aren\'t clear +unless the reader already has a solid understanding of the auditing +profession. To further explain, the following is a list of definitions +that can help supplement understanding of internal auditing. + +## Independent + +Independence is the freedom from conditions that threaten the ability of +the internal audit activity to carry out internal audit responsibilities +in an unbiased manner. To achieve the degree of independence necessary +to effectively carry out the responsibilities of the internal audit +activity, the chief audit executive has direct and unrestricted access +to senior management and the board. This can be achieved through a +dual-reporting relationship. Threats to independence must be managed at +the individual auditor, engagement, functional, and organizational +levels. + +## Objective + +Objectivity is an unbiased mental attitude that allows internal auditors +to perform engagements in such a manner that they believe in their work +product and that no quality compromises are made. Objectivity requires +that internal auditors do not subordinate their judgment on audit +matters to others. Threats to objectivity must be managed at the +individual auditor, engagement, functional, and organizational levels. + +## Assurance + +Assurance services involve the internal auditor\'s objective assessment +of evidence to provide opinions or conclusions regarding an entity, +operation, function, process, system, or other subject matters. The +internal auditor determines the nature and scope of an assurance +engagement. Generally, three parties are participants in assurance +services: (1) the person or group directly involved with the entity, +operation, function, process, system, or other subject - (the process +owner), (2) the person or group making the assessment - (the internal +auditor), and (3) the person or group using the assessment - (the user). + +## Consulting + +Consulting services are advisory in nature and are generally performed +at the specific request of an engagement client. The nature and scope of +the consulting engagement are subject to agreement with the engagement +client. Consulting services generally involve two parties: (1) the +person or group offering the advice (the internal auditor), and (2) the +person or group seeking and receiving the advice (the engagement +client). When performing consulting services, the internal auditor +should maintain objectivity and not assume management responsibility. + +## Governance, Risk Management, & Compliance (GRC) + +The integrated collection of capabilities that enable an organization to +reliably achieve objectives, address uncertainty and act with integrity. + +# Audit Charter & Standards + +First, it\'s important to note that not every organization needs +internal auditors. In fact, it\'s unwise for an organization to hire +internal auditors unless they have regulatory requirements for auditing +and have the capital to support the department. Internal audit is a cost +center that can only affect revenue indirectly. + +Once an organization determines the need for internal assurance +services, they will hire a Chief Audit Executive and create the audit +charter. This charter is a document, approved by the company\'s +governing body, that will define internal audit\'s purpose, authority, +responsibility, and position within the organization. Fortunately, the +IIA has model charters available to IIA members for those developing or +improving their charter. + +Beyond the charter and organizational documents, internal auditors +follow a few different standards in order to perform their job. First is +the International Professional Practices Framework (IPPF) by the IIA, +which is the model of standards for internal auditing. In addition, +ISACA\'s Information Technology Assurance Framework (ITAF) helps guide +auditors in reference to information technology (IT) compliance and +assurance. Finally, additional standards such as FASB, GAAP, and +industry-specific standards are used when performing internal audit +work. + +# Three Lines of Defense + +[The IIA](https://theiia.org) released the original Three Lines of +Defense model in 2013, but have released an updated version in 2020. +Here is what the Three Lines of Defense model has historically looked +like: + + + +I won\'t go into depth about the changes made to the model in this +article. Instead, let\'s take a look at the most current model. + + + +The updated model forgets the strict idea of areas performing their own +functions or line of defense. Instead of talking about management, risk, +and internal audit as 1-2-3, the new model creates a more fluid and +cooperative model. + +Looking at this model from an auditing perspective shows us that +auditors will need to align, communicate, and collaborate with +management, including business area managers and chief officers, as well +as reporting to the governing body. The governing body will instruct +internal audit *functionally* on their goals and track their progress +periodically. + +However, the internal audit department will report *administratively* to +a chief officer in the company for the purposes of collaboration, +direction, and assistance with the business. Note that in most +situations, the governing body is the audit committee on the company\'s +board of directors. + +The result of this structure is that internal audit is an independent +and objective function that can provide assurance over the topics they +audit. + +# Audit Process + +A normal audit will generally follow the same process, regardless of the +topic. However, certain special projects or abnormal business areas may +call for changes to the audit process. The audit process is not set in +stone, it\'s simply a set of best practices so that audits can be +performed consistently. + + + +While different organizations may tweak the process, it will generally +follow this flow: + +## 1. Risk Assessment + +The risk assessment part of the process has historically been performed +annually, but many organizations have moved to performing this process +much more frequently. In fact, some organizations are moving to an agile +approach that can take new risks into the risk assessment and +re-prioritize risk areas on-the-go. To perform a risk assessment, +leaders in internal audit will research industry risks, consult with +business leaders around the company, and perform analyses on company +data. + +Once a risk assessment has been documented, the audit department has a +prioritized list of risks that can be audited. This is usually in the +form of auditable entities, such as business areas or departments. + +## 2. Planning + +During the planning phase of an audit, auditors will meet with the +business area to discuss the various processes, controls, and risks +applicable to the business. This helps the auditors determine the scope +limits for the audit, as well as timing and subject-matter experts. +Certain documents will be created in this phase that will be used to +keep the audit on-track an in-scope as it goes forward. + +## 3. Testing + +The testing phase, also known as fieldwork or execution, is where +internal auditors will take the information they\'ve discovered and test +it against regulations, industry standards, company rules, best +practices, as well as validating that any processes are complete and +accurate. For example, an audit of HR would most likely examine +processes such as employee on-boarding, employee termination, security +of personally identifiable information (PII), or the IT systems involved +in these processes. Company standards would be examined and compared +against how the processes are actually being performed day-to-day, as +well as compared against regulations such as the Equal Employment +Opportunity (EEO), American with Disabilities Act, and National Labor +Relations Act. + +## 4. Reporting + +Once all the tests have been completed, the audit will enter the +reporting phase. This is when the audit team will conclude on the +evidence they\'ve collected, interviews they\'ve held, and any opinions +they\'ve formed on the controls in place. A summary of the audit +findings, conclusions, and specific recommendations are officially +communicated to the client through a draft report. Clients have the +opportunity to respond to the report and submit an action plan and time +frame. These responses become part of the final report which is +distributed to the appropriate level of administration. + +## 5. Follow-Up + +After audits have been completed and management has formed action plans +and time frames for audit issues, internal audit will follow up once +that due date has arrived. In most cases, the follow-up will simply +consist of a meeting to discuss how the action plan has been completed +and to request documentation to prove it. + +# Audit Department Structure + +While an internal audit department is most often thought of as a team of +full-time employees, there are actually many different ways in which a +department can be structured. As the world becomes more digital and +fast-paced, outsourcing has become a more attractive option for some +organizations. Internal audit can be fully outsourced or partially +outsourced, allowing for flexibility in cases where turnover is high. + +In addition, departments can implement a rotational model. This allows +for interested employees around the organization to rotate into the +internal audit department for a period of time, allowing them to obtain +knowledge of risks and controls and allowing the internal audit team to +obtain more business area knowledge. This program is popular in very +large organizations, but organizations tend to rotate lower-level audit +staff instead of managers. This helps prevent any significant knowledge +loss as auditors rotate out to business areas. + +# Consulting + +Consulting is not an easy task at any organization, especially for a +department that can have negative perceptions within the organization as +the \"compliance police.\" However, once an internal audit department +has delivered value to organization, adding consulting to their suite of +services is a smart move. In most cases, Internal Audit can insert +themselves into a consulting role without affecting the process of +project management at the company. This means that internal audit can +add objective assurance and opinions to business areas as they develop +new processes, instead of coming in periodically to audit an area and +file issues that could have been fixed at the beginning. + +# Data Science & Data Analytics + + + +One major piece of the internal audit function in the modern world is +data science. While the process is data science, most auditors will +refer to anything in this realm as data analytics. Hot topics such as +robotic process automation (RPA), machine learning (ML), and data mining +have taken over the auditing world in recent years. These technologies +have been immensely helpful with increasing the effectiveness and +efficiency of auditors. + +For example, mundane and repetitive tasks can be automated in order for +auditors to make more room in their schedules for labor-intensive work. +Further, auditors will need to adapt technologies like machine learning +in order to extract more value from the data they\'re using to form +conclusions. |