1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

150

151

152

153

154

155

156

157

158

159

160

161

162

163

164

165

166

167

168

169

170

171

172

173

174

175

176

177

178

179

180

181

182

183

184

185

186

187

188

189

190

191

192

193

194

195

196

197

198

199

200

201

202

203

204

205

206

207

208

209

210

211

212

213

214

215

216

217

218

219

220

221

222

223

224

225

226

227

228

229

230

231

|

+++

date = 2019-09-09

title = "Data Analysis in Auditing"

description = "Learn how to use data analysis in the world of auditing."

+++

# What Are Data Analytics?

A quick aside before I dive into this post: `data analytics` is a

vague term that has become popular in recent years. Think of a `data

analytic` as the output of any data analysis you perform. For example,

a pivot table or a pie chart could be a data analytic.

[Data analysis](https://en.wikipedia.org/wiki/Data_analysis) is a

process that utilizes statistics and other mathematical methods to

discover useful information within datasets. This involves examining,

cleaning, transforming, and modeling data so that you can use the data

to support an opinion, create more useful viewpoints, and gain knowledge

to implement into audit planning or risk assessments.

One of the common mistakes that managers (and anyone new to the process)

make is assuming that everything involved with this process is "data

analytics". In fact, data analytics are only a small part of the

process.

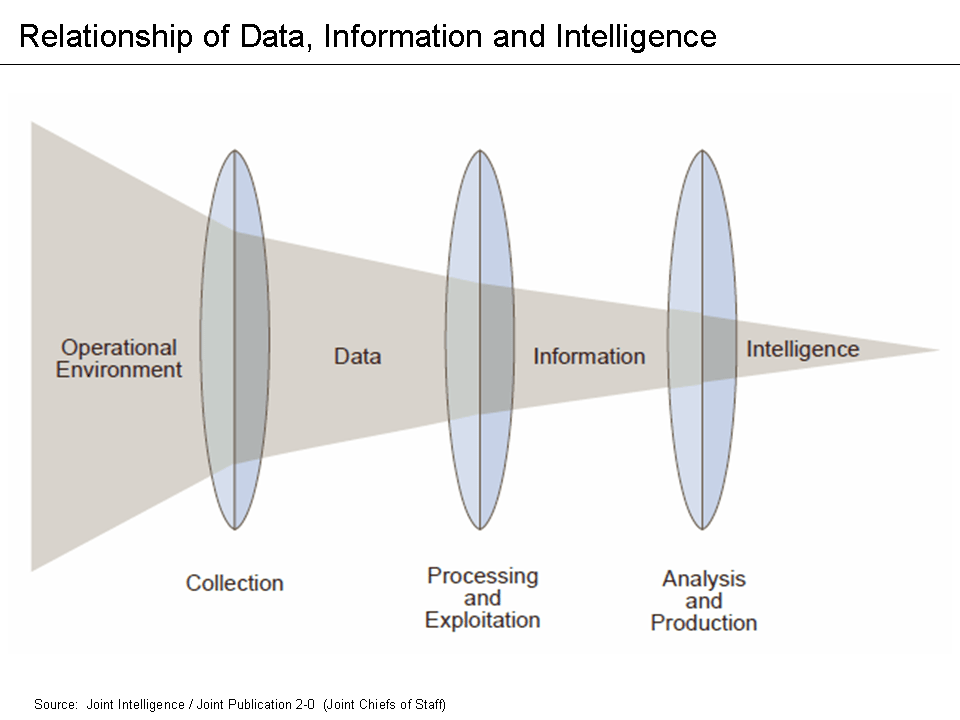

See **Figure 1** for a more accurate representation of where data

analysis sits within the full process. This means that data analysis

does not include querying or extracting data, selecting samples, or

performing audit tests. These steps can be necessary for an audit (and

may even be performed by the same associates), but they are not data

analytics.

# Current Use of Analytics in Auditing

While data analysis has been an integral part of most businesses and

departments for the better part of the last century, only recently have

internal audit functions been adopting this practice. The internal audit

function works exclusively to provide assurance and consulting services

to the business areas within the firm (except for internal auditing

firms who are hired by different companies to perform their roles).

> Internal Auditing helps an organization accomplish its objectives by

> bringing a systematic, disciplined approach to evaluate and improve

> the effectiveness of risk management, control and governance

> processes.

>

> - The IIA's Definition of Internal Audit

Part of the blame for the slow adoption of data analysis can be

attributed to the fact that internal auditing is strongly based on

tradition and following the precedents set by previous auditors.

However, there can be no progress without auditors who are willing to

break the mold and test new audit techniques. In fact, as of 2018, [only

63% of internal audit departments currently utilize data

analytics](https://www.cpapracticeadvisor.com/accounting-audit/news/12404086/internal-audit-groups-are-lagging-in-data-analytics)

in North America. This number should be as close as possible to 100%. I

have never been part of an audit that would not have benefited from data

analytics.

So, how do internal audit functions remedy this situation? It's

definitely not as easy as walking into work on Monday and telling your

Chief Audit Executive that you're going to start implementing analytics

in the next audit. You need a plan and a system to make the analysis

process as effective as possible.

# The DELTA Model

One of the easiest ways to experiment with data analytics and gain an

understanding of the processes is to implement them within your own

department. But how do we do this if we've never worked with analysis

before? One of the most common places to start is to research some data

analysis models currently available. For this post, we'll take a look

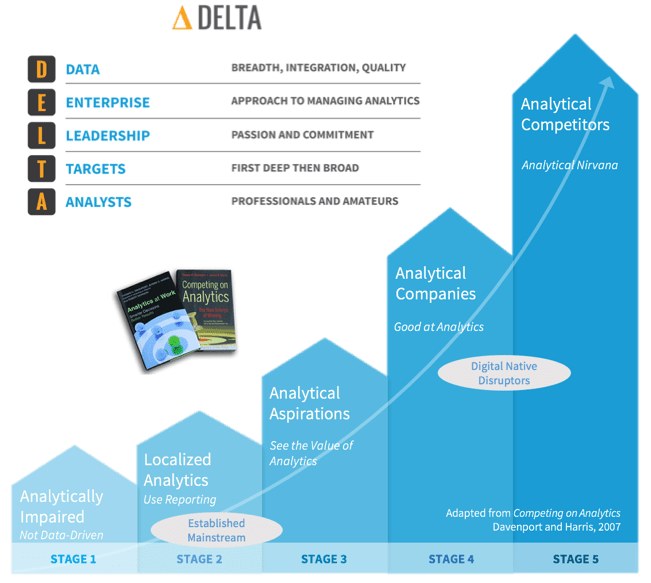

at the DELTA model. You can take a look at ****Figure 2**** for a quick

overview of the model.

The DELTA model sets a few guidelines for areas wanting to implement

data analytics so that the results can be as comprehensive as possible:

- **Data**: Must be clean, accessible, and (usually) unique.

- **Enterprise-Wide Focus**: Key data systems and analytical resources

must be available for use (by the Internal Audit Function).

- **Leaders**: Must promote a data analytics approach and show the

value of analytical results.

- **Targets**: Must be set for key areas and risks that the analytics

can be compared against (KPIs).

- **Analysts**: There must be auditors willing and able to perform

data analytics or else the system cannot be sustained.

# Finding the Proper KPIs

Once the Internal Audit Function has decided that they want to start

using data analytics internally and have ensured they're properly set

up to do so, they need to figure out what they will be testing against.

Key Performance Indicators (KPIs) are qualitative or quantitative

factors that can be evaluated and assessed to determine if the

department is performing well, usually compared to historical or

industry benchmarks. Once KPIs have been agreed upon and set, auditors

can use data analytics to assess and report on these KPIs. This allows

the person performing the analytics the freedom to express opinions on

the results, whereas the results are ambiguous if no KPIs exist.

It should be noted that tracking KPIs in the department can help ensure

you have a rigorous Quality Assurance and Improvement Program (QAIP) in

accordance with some applicable standards, such as IPPF Standard 1300.

> The chief audit executive must develop and maintain a quality assurance

> and improvement program that covers all aspects of the internal audit

> activity.

>

> - IPPF Standard 1300

Additionally, IPPF Standard 2060 discusses reporting:

> The chief audit executive must report periodically to senior

> management and the board on the internal audit activity's purpose,

> authority, responsibility, and performance relative to its plan and on

> its conformance with the Code of Ethics and the Standards. Reporting

> must also include significant risk and control issues, including fraud

> risks, governance issues, and other matters that require the attention

> of senior management and/or the board.

>

> - IPPF Standard 2060

The hardest part of finding KPIs is to determine which KPIs are

appropriate for your department. Since every department is different and

has different goals, KPIs will vary drastically between companies. To

give you an idea of where to look, here are some ideas I came up with

when discussing the topic with a few colleagues.

- Efficiency/Budgeting:

- Audit hours to staff utilization ratio (annual hours divided by

total annual work hours).

- Audit hours compared to the number of audits completed.

- Time between audit steps or to complete the whole audit. E.g.,

time from fieldwork completion to audit report issuance.

- Reputation:

- The frequency that management has requested the services of the

IAF.

- Management, audit committee, or external audit satisfaction

survey results.

- Education, experience, certifications, tenure, and training of

the auditors on staff.

- Quality:

- Number and frequency of audit findings. Assign monetary or

numerical values, if possible.

- Percentage of recommendations issued and implemented.

- Planning:

- Percentage or number of key risks audited per year or per audit.

- Proportion of audit universe audited per year.

# Data Analysis Tools

Finally, to be able to analyze and report on the data analysis, auditors

need to evaluate the tools at their disposal. There are many options

available, but a few of the most common ones can easily get the job

done. For example, almost every auditor already has access to Microsoft

Excel. Excel is more powerful than most people give it credit for and

can accomplish a lot of basic statistics without much work. If you

don't know a lot about statistics but still want to see some of the

more basic results, Excel is a great option.

To perform more in-depth statistical analysis or to explore large

datasets that Excel cannot handle, auditors will need to explore other

options. The big three that have had a lot of success in recent years

are Python, R, and ACL. ACL can be used as either a graphical tool

(point and click) or as a scripting tool, where the auditor must write

the scripts manually. Python and the R-language are solely scripting

languages.

The general trend in the data analytics environment is that if the tool

allows you to do everything by clicking buttons or dragging elements,

you won't be able to fully utilize the analytics you need. The most

robust solutions are created by those who understand how to write the

scripts manually. It should be noted that as the utility of a tool

increases, it usually means that the learning curve for that tool will

also be higher. It will take auditors longer to learn how to utilize

Python, R, or ACL versus learning how to utilize Excel.

# Visualization

Once an auditor has finally found the right data, KPIs, and tools, they

must report these results so that actions can be taken. Performing

in-depth data analysis is only useful if the results are understood by

the audiences of the data. The best way to create this understanding is

to visualize the results of the data. Let's take a look at some of the

best options to visualize and report the results you've found.

Some of the most popular commercial tools for visualization are

Microsoft PowerBI and Tableau Desktop. However, other tools exist such

as JMP, Plotly, Qlikview, Alteryx, or D3. Some require commercial

licenses while others are simply free to use. For corporate data, you

may want to make sure that the tool does not communicate any of the data

outside the company (such as cloud storage). I won't be going into

depth on any of these tools since visualization is largely a subjective

and creative experience, but remember to constantly explore new options

as you repeat the process.

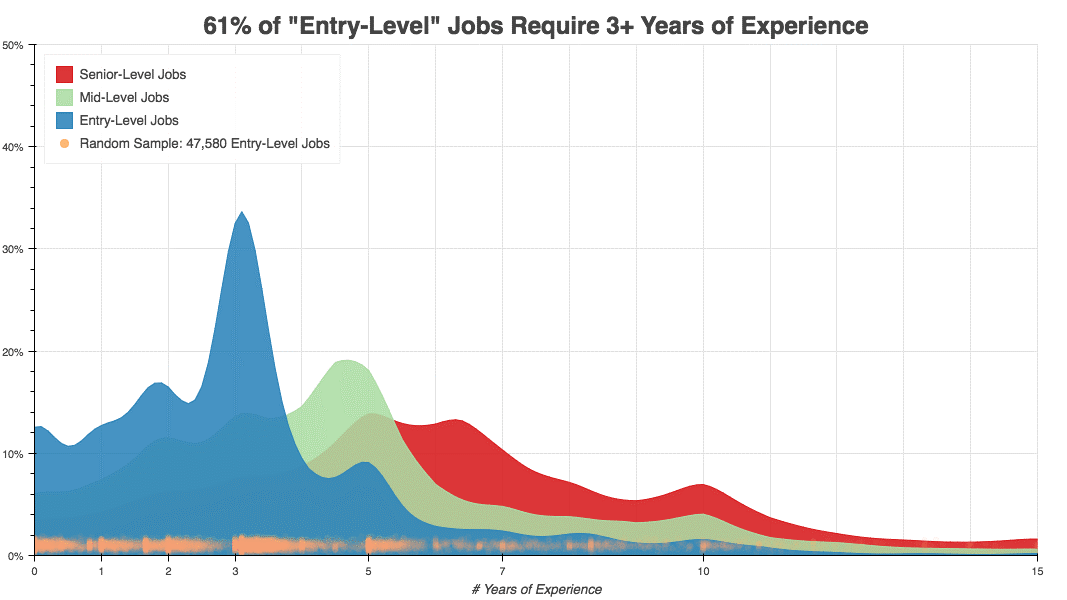

Lastly, let's take a look at an example of data visualization. This

example comes from a [blog post written by Kushal

Chakrabarti](https://talent.works/2018/03/28/the-science-of-the-job-search-part-iii-61-of-entry-level-jobs-require-3-years-of-experience/)

in 2018 about the percent of entry-level US jobs that require

experience. **Figure 3** shows us an easy-to-digest picture of the data.

We can quickly tell that only about 12.5% of entry-level jobs don't

require experience.

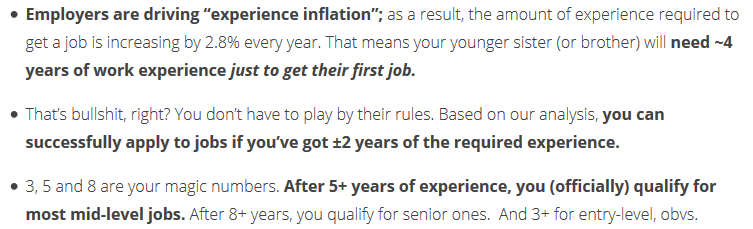

This is the kind of result that easily describes the data for you.

However, make sure to include an explanation of what the results mean.

Don't let the reader assume what the data means, especially if it

relates to a complex subject. *Tell a story* about the data and why the

results matter. For example, **Figure 4** shows a part of the

explanation the author gives to illustrate his point.

# Wrap-Up

While this is not an all-encompassing program that you can just adopt

into your department, it should be enough to get anyone started on the

process of understanding and implementing data analytics. Always

remember to continue learning and exploring new options as your

processes grow and evolve.

|